Imported crude oil caters to about 85% of India’s fuel requirements, and import dependency is seen to fall due to muted demand. Global crude oil prices have been tanking for a while now and yet, fuel prices in India have remained firm. Does it make sense?

Read through to get a sense of how actually the dearest commodity for a common man is priced by the Indian government.

We all know that crude oil isn’t the end product. It’s an intermediary that requires additional refining. We don’t get petrol or diesel, right off the bat. We need to pump crude through a processing facility, hoping to turn it into a consumable product. And herein lies the key distinction.

The pricing methodology-

Pic1: General comparison of fuel prices in India, Jan-July 2020.

Pic2: Break up of various parameters that are involved while calculating the fuel prices. (July2020)

Pic3: Comparison of Excise Duty and VAT between Nov2014 to Jul2020

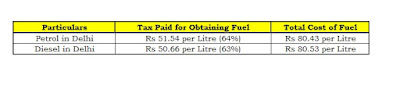

Pic4: How much tax a person who is living in DELHI is paying per liter of Petrol and Diesel

For infographics, click on the below link. - https://www.linkedin.com/pulse/base-price-petrol-paltry-rs18-consumer-ending-up-275-kundurthi-pk-/?published=t

Excise price hike

With the May 4 2020 decision of state governments to raise VAT and it is more than 30% on petrol in almost every state in India.

Similarly, the Centre's decision to raise excise duties on petrol and diesel by Rs.10/1L and Rs.13/1L, respectively had taken up the component of this tax on retail prices by Rs.32.98/1L on petrol and Rs.31.83/1L on diesel.

So the total tax component (Centre and state in Delhi) is Rs.49.42/1L on petrol and Rs.48.09/1L on diesel. Compare this with the base price of the two products today and the tax load becomes clearly visible. The base price of petrol currently is mere Rs.17.96/1L and diesel just Rs.18.49/1L.

These two taxes cumulatively account for 69% of tax which is higher than anywhere else in the world. The same is taxed at 19% in the US, 47% in Japan, 62% in UK and 63% in France. The government does not pass on the benefit of lower crude oil prices to the customer.

It is to be noted that Indian consumers continued to pay Rs.70/1L even when crude oil prices hit a paltry $20/barrel on April 12.

Why prices are so high in India?

Although the crude oil prices are hovering around $40 - $50 per barrel as opposed to $107 per barrel in 2013-14, the petrol prices are at all-time high. Prices of petrol and diesel in India have witnessed a steady increase in the past four years as the government has hiked excise duties on fuels a dozen times in this period.

As a result, the current NDA government gets Rs 10 per litre excise duty more on petrol than what the UPA government got in 2014. For diesel, the government gets almost Rs 11 per litre more than the previous government.

Aside from slight variations in the price due to currency exchange rates and other international reasons, what is creating a gigantic wall of difference in fuel prices before and after 2013-14 are the increased rates of excise duty imposed by the government.

The decision of the government to raise excise duty levels on petrol and diesel by historic high levels has taken up tax component on retail price of auto fuels closer to 70 per cent level.

What this means is that the bulk of the retail price a common man pays to get fuel is tax and if government would not have targeted petrol and diesel to raise revenue every time there is a pressing need for it, the fuel prices in India today would have mirrored retail prices prevailing decades ago (in 2003) and closer to what consumers in oil rich countries in the Gulf pay.

What this means is that the bulk of the retail price a common man pays to get fuel is tax and if government would not have targeted petrol and diesel to raise revenue every time there is a pressing need for it, the fuel prices in India today would have mirrored retail prices prevailing decades ago (in 2003) and closer to what consumers in oil rich countries in the Gulf pay.

Indians pay more tax on petrol than anywhere else in the world is no surprise. Owing to low direct tax collection, the government has to ramp up tax collection through indirect sources and fuel is a good source for the same.

Opposition parties are unitedly protesting the rise in fuel prices and participating in the nationwide shutdown which was called by the Congress party last week. The peculiar thing about the price hike is that the countries which buy petrol from India are selling it at a price lower than India.

Auto fuels comprise 20-30% of revenue of state governments while it forms a significant portion of excise revenue for states. As these fuels are still out of GST raising duties is easier for both the center and states that target the product to raise revenue whenever there is an emergency.

But high set price of fuel also adds inflationary pressure on the economy that would just not be right at this juncture when the country is fighting the coronavirus outbreak.

In the end I want to conclude by saying that-

May your happiness increase like FUEL PRICES in India

In the next article I am going to discuss on why the government taps on the fuel prices while it wants to increase its revenues and many more interesting things on the dearest commodity for a common man.

For more information,

People can get in touch with me in LinkedIN, Facebook, Instagram

PK,

PK Enterprises.

No comments:

Post a Comment